Investing in Air Liquide shares: understanding and calculating profitability

Published on September 16, 2019

7 minutes

Are you a shareholder or would you like to become one? Several factors help make an equity investment profitable. Share price performance is not the only criterion to take into account: let’s see why with a closer look at Air Liquide shares.

By choosing to become a shareholder, you’re placing your trust in a company and supporting it in the development of its business. You’re investing your money in the economy and you expect to receive financial remuneration for this investment, so it’s important for you to be able to measure your investment’s overall performance—the amount your shares have earned for you since your initial investment.

“Share price performance is not the only factor to take into account when assessing the profitability of an equity investment over the long term. In addition to this stock market performance, you must also factor in all the parameters that boost your portfolio over time: these include dividends, but also, for Air Liquide shares, regular free share attributions and the loyalty bonus.

”

Patrick Renard

Head of Air Liquide’s Shareholder Services

4 key factors to measure the return on your shares

In addition to share price performance, three other factors help boost your portfolio’s return:

- dividends: This remuneration is paid to you each year by the company in which you have invested. Each year, Air Liquide pays its shareholders a dividend approved during the Shareholders’ Meeting, the total amount of which historically accounts for around 50% of the company’s net profit. This dividend contributes even more to your return on investment if you reinvest it in shares each year.

- free share attributions: Air Liquide regularly grants free shares to all its shareholders. Although this offer does not have an immediate effect on the value of your portfolio, it increases your dividend rights the following year.

As a general rule, one free share is allocated for every 10 shares owned. For a constant dividend, this would correspond to a shareholder receiving an additional 10% in dividends the year following this offer. Air Liquide has a policy of never decreasing the unit value of its dividend.

On October 9 this year, Air Liquide will carry out its 30th free share attribution since the company’s creation.

- The loyalty bonus: This is a 10% bonus on the amount of dividends received and the number of free shares allocated.

How do you calculate your shares’ earnings since your initial investment?

Once you have identified these four parameters, it’s time to do some math! The “Total Shareholder Return” (TSR) is “the most efficient method to establish the overall profitability of your equity investment over time” according to Patrick Renard, Head of Air Liquide’s Shareholder Services.

Expressed as an average percentage per year, Total Shareholder Return can be compared with the interest rate that would have remunerated your capital if you had placed it in an interest-bearing bank account instead of in a securities account. TSR allows you to directly compare the return on your equity investment to the return on your investments in more classic savings products (such as the French Livret A).

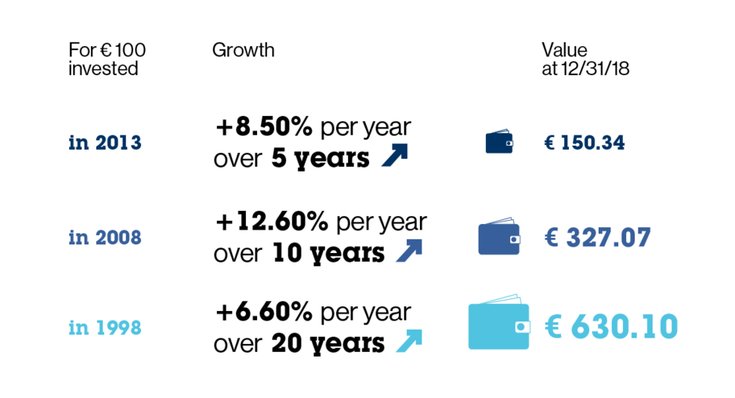

The TSR presented below was calculated based on a registered shareholder eligible for the loyalty bonus, who has benefited from free share attributions and who reinvested dividends received in shares every year.

As a guide, Air Liquide has calculated the TSRs for a €100 investment in Air Liquide shares over the last 5, 10 and 20 years (at December 31, 2018).

Historically, these Air Liquide TSRs all fall within a range of 7 to 13% per year. Please note, however, that these calculations do not include taxation, as tax conditions vary depending on your personal situation, or financial fees, as conditions vary according to the form of shareholding chosen and the bank holding your shares1.

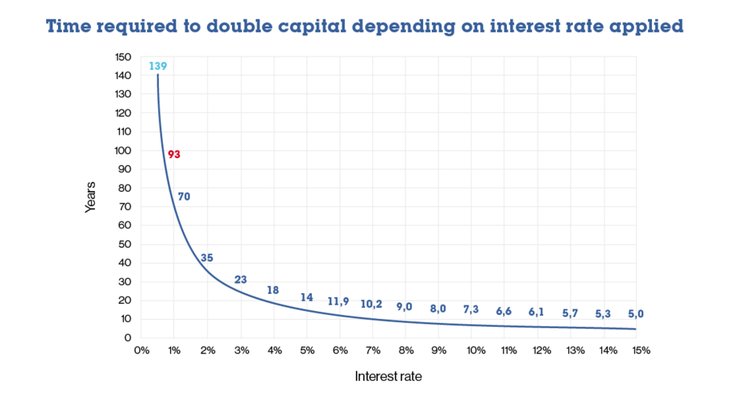

The following example shows a curve highlighting the time required for your portfolio to double in value depending on the TSR.

For example, it would take 93 years to double the value of your portfolio at a rate of 0.75% (the current French Livret A savings product rate) and 139 years at a rate of 0.5% (the current French Compte Épargne Logement mortgage savings account rate). Two easy-to- remember points: it would take around 10 years at a rate of 7% and 7 years at a rate of 10%.

You can reinvest your dividends in shares

This would allow you to increase the value of your portfolio without any further personal investment.

You can round up the number of shares you own to a multiple of 10 before free share attributions.

This will ensure you do not receive “fractional rights”, meaning a portion of shares that cannot be distributed under the free share attribution, and which is subject to income tax.

For example, if you own 297 shares at the time of the free share attribution on October 9, 2019, you will receive 29 free shares (1 free share for every 10 owned) and 0.7 fractions of a share, which is paid in cash and subject to capital gains tax. If you buy three additional shares before October 4, 2019 (purchasing deadline to be eligible for free shares), increasing your portfolio to 300 shares, you will receive 30 free shares and no fractional rights.

You can opt for direct registered shares.

This method of ownership means you don’t pay handling or management fees. You will also receive a reduced brokerage rate. Learn more thanks to our dedicated factsheet :

Find out more

Calculate your own TSR

1. Calculate the value of your current portfolio: A = current share price x number of shares owned

2. Don’t forget to take into account the dividends you have received:

- if you have reinvested them, they are already included in the number of shares owned and you’re all set!

- if you have not reinvested them, make a note of B = their net value

3. Don’t forget the free shares that you have been allocated: like the dividends, they have already been included in the number of shares owned, unless you have received “fractional rights” that you have not reinvested.

Make a note of C = the net amount of fractional rights received.

4. If you acquired your shares before the capital increase for the 2016 Airgas acquisition, you must take this offer into account:

a. If you did not subscribe to the capital increase, but instead sold your preferential subscription rights, make a note of D, which corresponds to the amount you received for their sale.

b. If you subscribed to the capital increase, make a note of E, which corresponds to the number of shares that you subscribed to, multiplied by their subscription cost of €76.

5. Measure F = the purchase cost less the fees relating to the shares in your portfolio: you can find this information on the transaction statement received when you purchase shares.

6. Calculate the seniority of your shares in months, M.

Convert it in annual duration N by dividing by 12 with 2 decimal places (example: if M = 50 months, N = 50/12 = 4,17 years).

7. Now you can calculate P = (A + B + C+ D)/(E + F), which will indicate by how much your investment has been multiplied since you purchased your shares.

Then to calculate the TSR, grab your calculator: take the Mth root of P by using either the xy or ^ button on your calculator:

=> the monthly TSR is P1/M - 1

What a calculation, right? That being said, since this is all performance-related, don’t forget that past performance is not necessarily an indicator of the future performance of your shares. The TSR provides you with a snapshot of your portfolio’s return at a given moment, but this should not be considered as a promise of a similar return over the next 30 years.