2015 Annual General Meeting

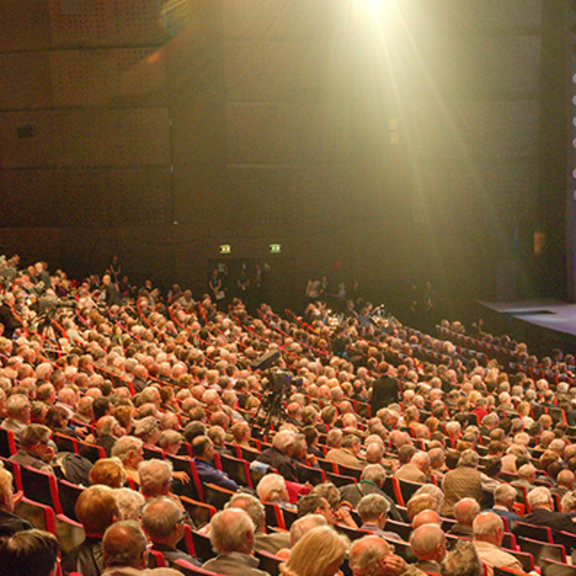

Each year, Air Liquide invites you to follow its Annual General Meeting. In 2015, it was held on May 6 at the Palais des Congrès in Paris.

Replies to questions asked prior to the AGM

Capital

Questions from Ms Mouffron, Mr Christian Somnolet, Mr Napoléone and Mr Jean-Marc Roger:

Don’t you think a 2-for-one share split should be carried out to make the share more accessible for more small shareholders? Why has a 2-for-1 or even a 3-for 1 share split not been decided, as you led us to hope at a previous Annual Shareholders’ Meeting? Will it take place this year?

The Air Liquide share price has been higher than €100 for a few months. At the time of the last share split in June 2007, the share price was approximately €180. Furthermore, a market transaction of this kind is not without cost for your Group and has to be submitted for the vote of the shareholders.

The Group will remain attentive to ensuring the accessibility of the share for all its shareholders.

Question from Mr Lionel Lelièvre:

Is it possible for shareholders to receive their dividends either in cash or in new shares?

Our company does not propose the option of payment of the dividend in shares, as the costs of implementation of such a transaction are high. The Board regularly proposes free share issues, which enable shareholders to round out their portfolios.

Questions from Mr Jean-Marc Roger and Mr Régis Faye:

Free share issues are highly appreciated by the shareholders, and a way of fostering their loyalty well. In a context where Air Liquide’s profits are tending to stagnate a little, will it be possible for the free share issues to continue at the same pace? Is it appropriate to increase the dividend every year? What are the reasons for the increase in the rate of redistribution of the profit to 54%?

The Board of Directors is attentive to the Group’s main financial balances when setting the dividend and at the time of free share issues. Free share issues are not only linked to the increase in profit but are also aimed at rewarding shareholder loyalty by maintaining share liquidity.

In light of the modest increase of 1.5% in profit for 2014, the Board of Directors has proposed to maintain the amount of the dividend per share at €2.55. However, last year, the shareholders benefited from an issue of one free share for 10 existing shares. The amount distributed has therefore risen by 10% after taking into account the new number of shares, which accounts for the increase in the distribution rate to 54%.

Two questions from Ms Mouffron and Mr Napoléone

Do you plan on using the authorisation of an increase in share capital this year?

The authorisations of an increase in capital requested at the Annual Shareholders’ Meeting provide the Group with flexibility in its financing strategy in the event that it might have to finance a major investment.

Why not use part of the retained earnings to reduce the debt and replace it partly by a debt at a lower interest rate?

The retained earnings of €5.5 billion in the accounts of the parent company essentially result from an exceptional distribution of reserves by a subsidiary, already used to repay nearly €4 billion in debt. The Group strives to minimise its cost of debt, which remained stable at 4% in 2014. The cost of the debt in Euro has effectively been reduced through the refinancing of older loans. On the other hand, in light of our growth model, the portion of the debt in the developing economies has increased, and the cost of such debt is higher.

Business activities

Question from Mr Bertrand Gizard

Where does the company stand with the start-up of the Yanbu hydrogen unit in Saudi Arabia?

Our hydrogen plant in Yanbu is in the start-up phase and has supplied its first gas molecules to the refinery of our customer Yasref.

Two questions from Mr Jean-Jacques Frechet

The first concerns the use of hydrogen as an alternative fuel in internal combustion engines and for the diesel engines of generators. Can local hydrogen production be envisaged in such case?

Air Liquide is actively involved in the development of the hydrogen energy sector in respect of the use of hydrogen for the fuel cell which produces electricity. Air Liquide has set up sixty or so hydrogen filling stations worldwide and several car manufacturers have launched on the market production cars that operate using hydrogen cells. Hydrogen is no longer envisaged as a fuel in the internal combustion engine. It can indeed be envisaged to produce hydrogen near filling stations. Experiments are being conducted in various parts of the world in this respect.

Can you provide any information concerning the production of hydrazine by Air Liquide?

Hydrazine is a fuel used by some spacecraft (e.g.: the former generation Ariane). Air Liquide is not involved in the production of hydrazine.

-

Minutes from the Combined Shareholders’ Meeting of May 6, 2015

Download the document PDF (2.58 MB) -

Vote per resolution

Download the document PDF (125.21 KB) -

Press release dated May 6, 2015

Download the document PDF (198.52 KB) -

Formulaire de vote

Download the document PDF (3.63 MB) -

Avis de convocation

Download the document PDF (2.42 MB) -

Avis de convocation publié au Balo

Download the document PDF (131.41 KB) -

2015 Proposed resolutions and purpose (Extracted from 2014 Reference Document)

Download the document PDF (278.95 KB) -

Résolutions 2015 et objectifs (extrait du Document de Référence 2014)

Download the document PDF (289.93 KB) -

Délégations de compétences de l'Assemblée Générale (extrait du Document de Référence 2014)

Download the document PDF (53.13 KB) -

Droits de vote au 20 février 2015

Download the document PDF (40.79 KB) -

Avis de réunion publié au Balo

Download the document PDF (205.22 KB)