First Quarter 2016 Revenue

April 26, 2016

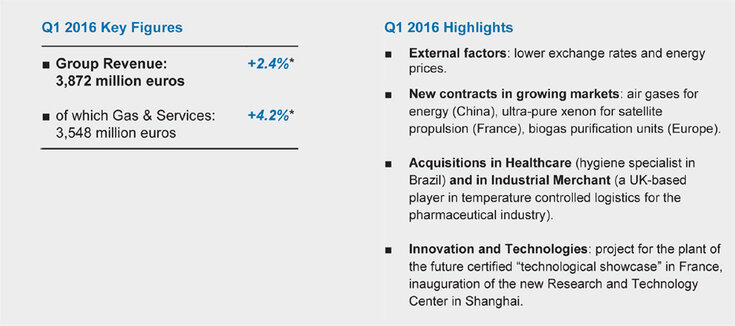

* Change Q1 2016/Q1 2015 on a comparable basis: excluding currency, energy, and significant M&A impacts.

-

Press release dated April 26, 2016 and Management Report

Download the document PDF (417.2 KB) -

Presentation dated April 26, 2016

Download the document PDF (2.5 MB)