Financing tools

Access to different debt markets

Air Liquide diversifies its financing sources by accessing various debt markets. In the long run, the Group funds itself with bond issues, usually through its Euro Medium-Term Notes programme (EMTN), targeting European, American, as well as Chinese markets. Over the short term, Air Liquide has recourse to Negotiable European Commercial Paper (formerly Billet de Tresorerie) and US Commercial Paper. The Group has also access to a Syndicated Credit Facility and several bilateral credit facilities with the Group’s core banking partners for general corporate purposes.

EMTN: European Medium Term Notes

- Download the first supplement of the Debt Issuance programme prospectus dated March 12, 2025

- Download the Debt Issuance programme prospectus dated May 22, 2024

- Download all documents incorporated by reference to the Debt Issuance programme prospectus

- Download the Guarantee of L'Air Liquide S.A. dated May 11, 2022

- Archives

Short term programs

- Download the Negotiable European Commercial Paper (NEU CP) Programme of L'Air Liquide S.A. (available in French only)

- Download the Negotiable European Commercial Paper (NEU CP) Programme of Air Liquide Finance (available in French only)

- US Commercial Paper Programme

Syndicated credit facility

Air Liquide’s policy requires that confirmed credit lines back all commercial paper issues.

For this reason, the Group holds a 3 billion euros syndicated credit facility with its core banking partners, maturing in 2030.

Bilateral credit facilities

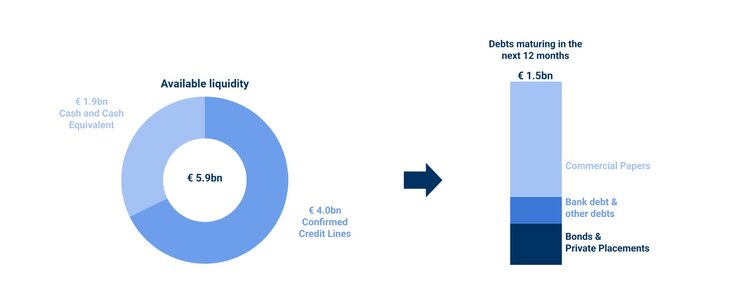

Air Liquide has also contracted bilateral credit facilities with its core banking partners. As of December 31 2024, the total amount of undrawn committed credit lines reached 4 billion euros including the Syndicated Credit Facility.

Prudent liquidity management

As of December 31, 2024