Created in 2013, ALIAD (Air Liquide Venture Capital) aims to take minority stakes in innovative start-ups in three sectors: energy transition, health and digital. ALIAD positions itself on the technologies of the future by supporting start-ups to develop. These investments are going hand in hand with technological and/or business agreements between these companies and the entities of the Air Liquide Group.

Widening our range of horizons

Each investment is a new story for Air Liquide and contribute to develop new markets and new offers for our customers, supporting our long term ambition and vision. These partnerships with start-ups widen our range of horizons, making the Group work with a different ecosystem and working culture. Strong of its close to 10-year legacy, ALIAD is a recognized actor of the Venture Capital world, with an effective business and financial model and reiterates its ambition to play its role to support Air Liquide beyond traditional boundaries via innovation and a clear focus on clean techs.

Since its creation in 2013, ALIAD has invested in more than 35 start-ups. Amongst the success stories of the fund, Waga Energy and Inpria are two examples of the value that Air Liquide creates with start-ups via Venture Capital investments.

Waga Energy: an ALIAD supported start-up on the Euronext regulated market

"The Waga’s story illustrates well ALIAD’s purpose: develop innovations and support start-ups towards the industrialization of new greentech offers. We are very proud of what has been accomplished for the sake of the environment!” explains Vincent Brillault, ALIAD Managing Director.

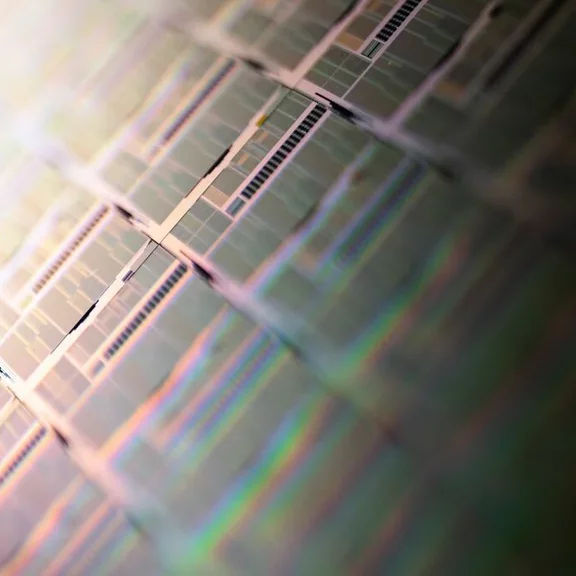

INPRIA, another success in the race for smaller nodes in the Electronics industry

With the support of Air Liquide’s Electronics business line, ALIAD has been an investor in INPRIA since 2015, alongside major stakeholders of the Electronics world such as Samsung, Intel, Applied Materials, JSR, Taiwan Semiconductor Manufacturing Corporation (TSMC) or SK hynix. Inpria also partnered with Air Liquide Advanced Materials (ALAM), for the scaleup of its materials manufacturing process.

"Through this partnership, Air Liquide has demonstrated once again its stewardship in new technologies in a field in which the Group has a strong position: Electronics and the supply of invisible molecules enabling the infinitely small", concludes Vincent Brillault.