Credit ratings

A regular assessment by Standard & Poor’s, Moody's and Scope Ratings

Air Liquide’s credit ratings are based upon its creditworthiness and its ability to repay its debt. The Group is regularly assessed by the credit rating agencies Standard & Poor’s, Moody’s and Scope Ratings.

Air Liquide’s credit ratings

|

Agencies |

Analyst |

Short - term |

Long - term |

Outlook |

Last update |

|

S&P |

Oliver Kroemker |

A-1 |

A |

Stable |

December 15, 2023 |

|

Moody's |

Sebastien Cieniewski |

P1 Last change (06/09/2022) |

A2 Last change (06/09/2022) |

Stable Last change (06/09/2022) |

September 29, 2023 |

|

Scope Ratings |

Ivan Castro Campos |

S-1 Last change (05/05/2023) |

A Last change (05/05/2023) |

Positive Last change (05/05/2023) |

May 5, 2023 |

Credit opinion published by S&P on December 15, 2023

Credit opinion published by Moody's on September 29, 2023

Credit opinion published by Scope Ratings on February 13, 2024

Standard & Poor's

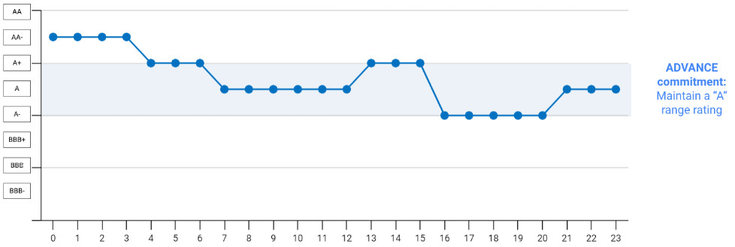

S&P long term credit ratings history

Rationales behind S&P A rating are excellent Business Risk as well as adequate Liquidity and an intermediate Financial Risk. S&P puts a strong focus on Air Liquide‘s earnings resilience and stable cash flow generation when analyzing the company's profitability and financial metrics. S&P views Air Liquide's profitability as less volatile than that of most specialty chemical companies. S&P underlines the high investments of Air Liquide in the energy transition and particularly in the hydrogen business which represents a significant growth opportunity for the Group.

The “stable” outlook means that Air Liquide benefits from a balanced financial profile, namely through the resilience of its CapEx, acquisitions, divestitures and shareholder distributions. S&P expects the FFO/Net debt ratio to remain sustainably over 30% for the next two years, thus enabling Air Liquide to maintain an “A” rating.

The agency rates corporate issuers as follows:

- Long-term ratings, in decreasing order: AAA (best), AA, A, BBB, BB, B, CCC, CC, C, D, SD (Selectively Defaulted). The rating is completed by + or -. Companies with ratings above BB+ are considered investment grade and those below non investment grade

- Short-term ratings, in decreasing order: A-1+ (best), A-1, A-2, A-3, B, C, D

Moody's

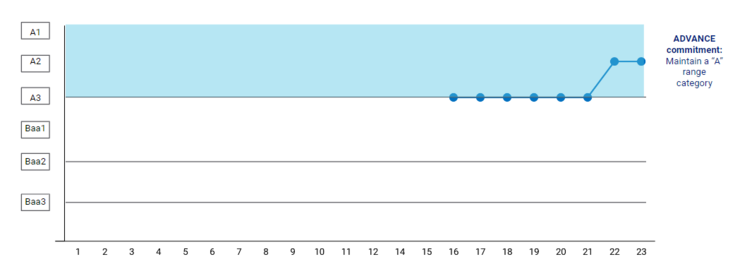

Moody’s long term credit ratings history

Both Air Liquide’s long term credit profile and short term credit profile were rated for the first time by Moody’s on May 24, 2016. Both ratings were upgraded in September 2022 (from A3 to A2 for the long term credit rating and from P-2 to P-1 for the short term credit rating) and associated with a stable outlook. Those ratings were both reaffirmed on September 29, 2023.

In its Credit Opinion dated 29 September 2023, Moody's highlights, among others, the robustness and the resilience of the Group’s profitability, its strong customer relationships and long-term contracts, as well as the diversification of the markets in which Air Liquide operates.

Moody’s rating scale:

- Long-term debt rating, in descending order: Aaa (highest rating), Aa, A, Baa, Ba, B, Caa, Ca, C (in "selective default"). The rating is completed by a 1 (best rating in the category), 2 or 3. Companies with a rating above BB+ are considered investment grade and those with a rating of Ba1 or below are considered non-investment grade.

- Short-term debt ratings, in descending order: P-1 (highest rating), P-2, P-3, “Not Prime”.

Scope Ratings

Scope published for the first time Air Liquide’s issuer rating of A with a “positive” outlook in May 2023. The rating is supported by Air Liquide’s strong profitability and reflects its market position, expertise, diversification, as well as its long-term contracts. Scope also included an evaluation of Air Liquide's ESG approach and considered it a positive factor in its assessment.

The “positive” outlook reflects the expectation that Air Liquide’s credit metrics will improve in the medium term.

The agency rates corporate issuers as follows:

- Long-term ratings, in decreasing order: AAA (best), AA, A, BBB, BB, B, CCC, CC, C, D. The rating is completed by + or -. Companies with ratings above BB+ are considered investment grade and those below non investment grade.

- Short-term ratings, in decreasing order: S-1+ (best), S-1, S-2, S-3, S-4.